AXIAN Investment applies a long-term fundamental approach to build a resilient portfolio of investments supporting the group’s goal of positive impact and shared values. Its activities, while return-driven, will back exceptional entrepreneurs transforming industries and creating opportunities across asset classes, sectors and geographies.

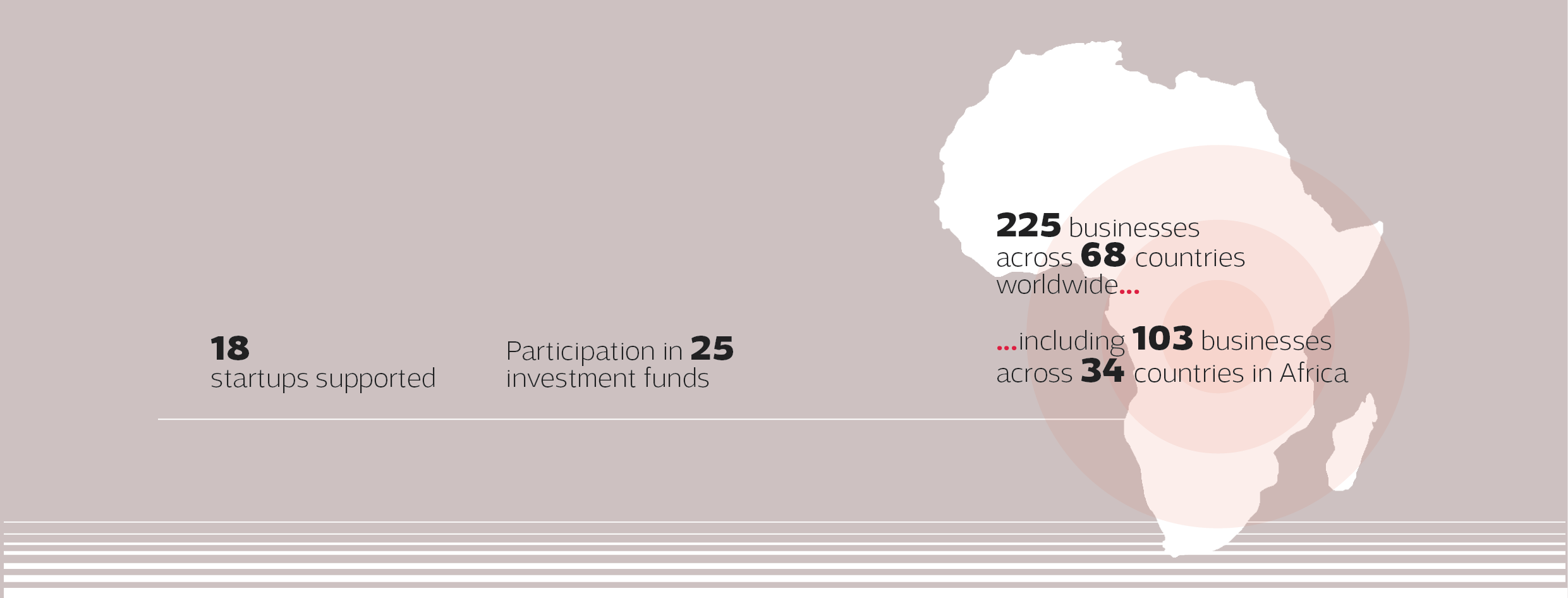

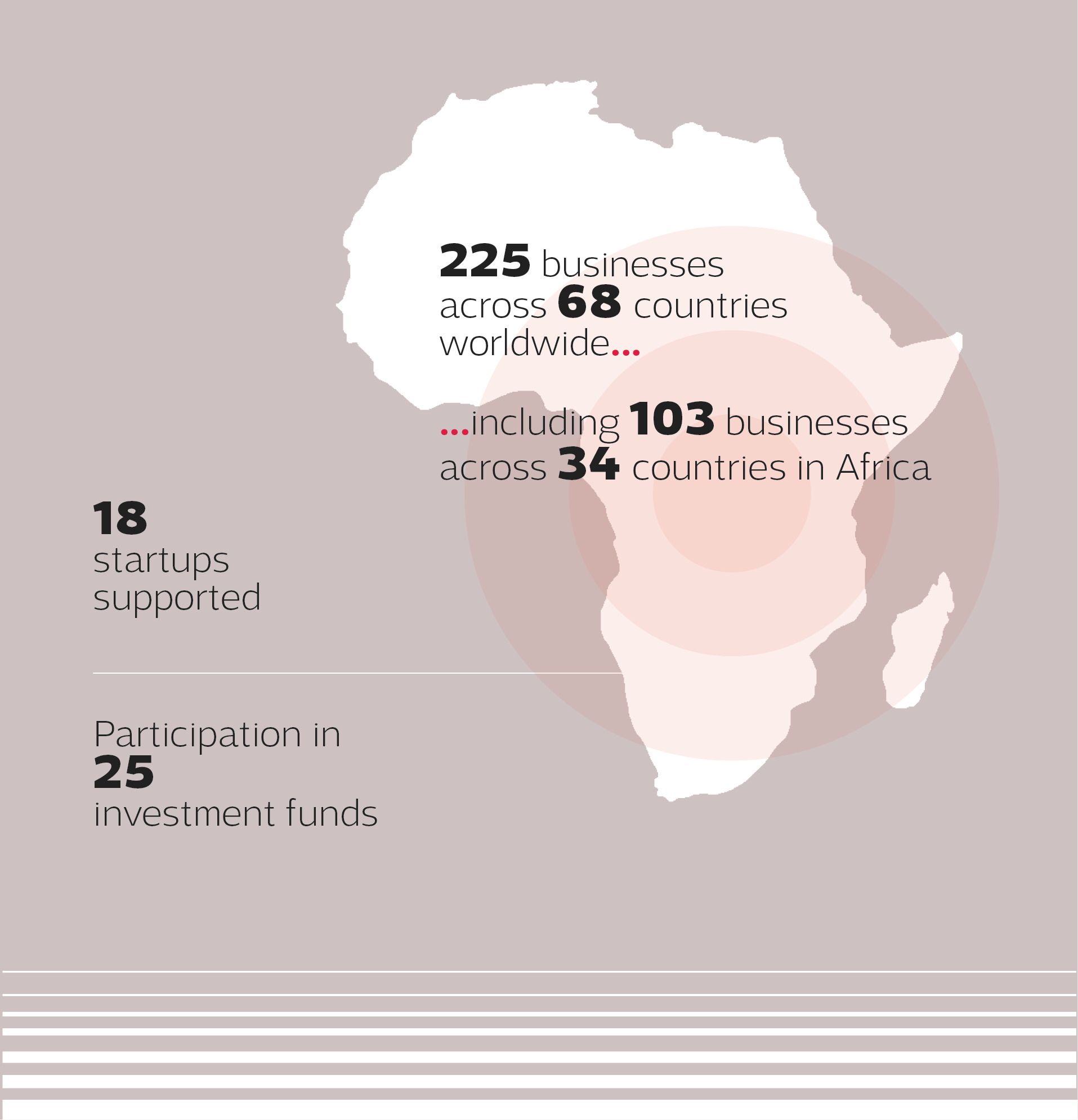

“AXIAN Investment will enable us to invest strategically in both Private Equity and Venture Capital, empowering businesses to create more value while contributing to economic growth in countries across Africa. Consolidating both branches of investment activity under one roof will allow us to reinforce our standing as the group’s lookout-point seeking innovation and opportunities across the continent. Our involvement in 77 businesses across 28 countries in Africa via both direct and indirect operations will allow the AXIAN Group to leverage this broad presence to become a first-rate, pan-African investor.”

Hassane Muhieddine

CEO of AXIAN Financial Services

Corporate Venture Capital

AXIAN Investment Corporate Venture Capital promotes actively a unique vision by supporting innovative and early-stage companies in Africa. Our investment thesis focuses on the tech-related ventures that have significant growth potential on their markets.

Our mission is to bring a different approach as a strategic partner to make the ecosystems grow on the long term. AXIAN Investment Corporate Venture Capital helps African start-ups to reach their full potential and create a sustainable cycle by positively impacting financial, digital and energy inclusion.

All

Insurtech

E-commerce

Fintech

Enterprise

Healthtech

Logistictech

Agricultural insurance and technology company that designs and delivers innovative agricultural insurance, and digital products to help smallholder farmers endure yield risks.

Sector Insurtech

Country Kenya

Wholesale player re-engineering the retail market using proprietary technologies, innovative supply chains, and embedded finance solutions designed to empower both retailers and suppliers.

Sector E-commerce

Country Egypt

Buy Now Pay Later operator allowing consumers to purchase goods and services by paying in monthly.

Sector Fintech

Country Kenya

E-commerce platform for small and medium retailers allowing easy ordering & financing for daily products.

Sector E-commerce

Country Nigeria

Neobank in Francophone Africa fully digital suite of banking services through a user-friendly app.

Sector Fintech

Country Ivoiry Coast

Payroll, benefits, compliance software company with embedded finance for local and remote teams in Africa.

Sector Enterprise

Country Kenya

Buy Now Pay Later offering quick, easy & affordable access to loans without collateral to merchants.

Sector Fintech

Country Egypt

Healthcare and telemedicine platform for companies to offer healthcare services to their employees.

Sector Healthtech

Country France

Cross-border e-logistics technology providing a digital platform for logistics workflows, end-to-end visibility and credit financing.

Sector Logistictech

Country Ghana

Aggregator of cross-border and remittance platforms helping users to compare various options, pay and send money within a single app.

Sector Fintech

Country Nigeria

Mobile application for telehealth services with online consultations and healthcare-related social network.

Sector Healthtech

Country Cameroon

E-commerce platform for FMCG products in Francophone Africa offering a wide range of services & products, including financing solutions.

Sector Logistictech

Country Morocco

One-stop shop payment platform for SMEs providing loans, business tools and financial services.

Sector Fintech

Country Nigeria

Integrated and reliable pharmaceutical marketplace, providing a data-driven solution for our customers that enhances the efficiency and effectiveness of their ordering processes.

Sector Healthtech

Country Egypt

Tanzanian health tech, offering a dependable pharmaceutical marketplace with fast delivery, revolutionizing medical logistics with an experienced team and an ‘asset-light’ model.

Sector Healthtech

Country Tanzania

Logistic platform-based technology improving delivery processing and first, middle, last miles delivery chain in Egypt and Saudi Arabia.

Sector Logistictech

Country Egypt

Digitizing credit collection using machine learning and digital communication channels to improve Non-Performing loans for banks, microfinance institutions and fintechs.

Sector Fintech

Country Nigeria

Integrated lending platform for 2 and 3 wheels light Electric Vehicle embarking a disruptive scoring engine and a loan management system

Sector Fintech

Country India

Tailored liquidity solutions for mobile banking services, short-term micro loans and longer-term facilty for agents, merchants and end-consumers.

Sector Fintech

Country Tanzania

FUND OF FUND

Amethis Fund II is a private equity investment focused on providing growth capital to African mid-cap champions through investments with an average ticket size of EUR 10-30m or more through co-investment.

Adenia makes values-based investments in promising African companies and takes responsibility for guiding them to sustainable growth.

ECP invest in companies that operate in business environments characterized by limited competition or in sectors in which Africa has a comparative advantage or an unmet need.

Founded in 2005, The EuroMena Funds is one of the MEA region’s leading private equity firms specialized in emerging markets with a track record of successful investments.

We are among Africa’s leading international investment and private equity institutions. We believe that partnership with our investee company management teams, along with our investors is key to our success.

We invest on a global scale in buy and build power generation and distribution businesses, driven by strong market demand and growth, supporting the energy transition and accelerating the journey to net zero.

Partech Africa is an investment platform for tech and digital companies, bringing together capital and resources to support entrepreneurs at all stages in Africa.

blisce/ is a growth stage venture capital fund focused on scaling consumer technology startups across the US and Europe.

We invest in extraordinary fintech entrepreneurs that will define the next era of financial services innovation.

Since 1999 TLcom has supported tech entrepreneurs in Europe, US and Africa across all technology sectors, from semiconductor manufacturing to mobile solutions and services, and at all stages of development, from seed to growth capital.

We decided long ago that an open, collaborative culture was the right choice for our firm and our clients. By actively sharing research and challenging one another’s views and potential blind spots, our investors create a diverse marketplace of ideas.

For 30 years, our job has been to reveal the potential of the companies we support by enabling them to innovate and grow in a sustainable manner.

First European WEB 3 fund dedicated to Luxury, Arts, Music and Sports

Based in London and Paris, we typically invest in early stage (Series A) startups based in Europe and later stage startups seeking to expand into European markets.

We’re EQT Ventures, a VC built by former founders and operators ready to support the next generation of global winners.

KKR is a leading global investment firm that offers alternative asset management as well as capital markets and insurance solutions.

We use cookies to give you the best experience when using our website. With your permission, we also set analytics cookies and social media cookies. For more information please see our privacy policy.

Cookie name

pll_language

Host

axian-group.com

Duration

One year

Type

First Party

Cookie name

cookie_axian

Host

axian-group

Duration

One year

Type

Third Party

Cookie name

axian_google_analytics_ga

Host

axian-group

Duration

31 days

Type

First Party

Cookie name

axian_google_analytics_ga_PPJF4HVKJY

Host

axian-group

Duration

31 days

Type

First Party

Cookie name

analytics_axian

Host

axian-group

Duration

One year

Type

Third Party

We use cookies to give you the best experience when using our website. With your permission, we also set analytics cookies and social media cookies. You can click “Allow all” below if you are happy for us to place cookies (you can always change your mind later). For more information please see our privacy policy

Always active

These cookies are strictly necessary to provide you with the services and features available through our site. Because these cookies are strictly necessary to deliver the site, you cannot refuse them without impacting how the site functions.

Cookie detailsThese cookies are used to enhance the functionality of the site. They help us to customize the site and application (where applicable) for you in order to enhance your experience. Although important to us, these cookies are non-essential to the use of the site. However, without these cookies, certain functionality may become unavailable.

Cookie detailsThese cookies allow us to count visits and traffic sources so we can measure and improve the performance of our site. All information these cookies collect is aggregated and therefore anonymous.

Cookie detailsThese cookies allow us to integrate social media functions into our Sites.

Cookie details

<- Cookies list

Cookie name

VISITOR_INFOLINE

Host

youtube.com

Duration

6 months

Type

Third Party

Cookie name

YSC

Host

youtube.com

Duration

Session

Type

Third Party

Cookie name

media_axian

Host

axian-group

Duration

One year

Type

Third Party